|

| October 19, 2021 | Volume 17 Issue 39 |

Designfax weekly eMagazine

Archives

Partners

Manufacturing Center

Product Spotlight

Modern Applications News

Metalworking Ideas For

Today's Job Shops

Tooling and Production

Strategies for large

metalworking plants

Latest Trends: Li-ion batteries and motor types in electric vehicles

By IDTechEx

Overall, worldwide electric car sales were stronger than expected in 2020. Additionally, investment continued to pour into electric vehicles and Li-ion batteries, with 2020 seeing an additional 200 GWh of planned capacity announcements in Europe alone -- and this figure continues to grow on a regular basis in 2021.

The past year has also seen Tesla, Volkswagen, General Motors, Ford, SK Innovation, and LG Chem all come forward with investor days and presentations outlining their vehicle electrification and battery technology strategies, all of which adds to the growing momentum behind the electric vehicle market. With this comes the added importance of understanding the Li-ion batteries that power electric vehicles, the variety of design choices available, and the latest trends in their implementation.

Cathode chemistry

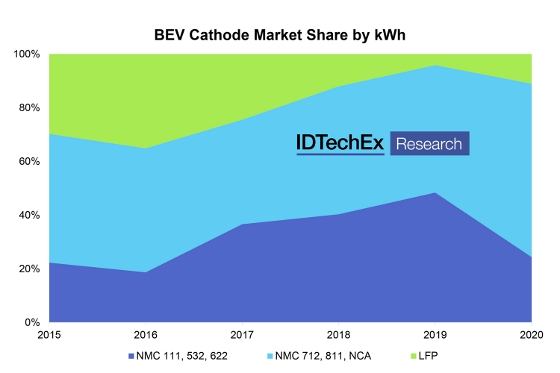

An area of particular interest has been the cathode and chemistry choices being made by battery companies and automotive OEMs. IDTechEx data shows there has been a shift toward higher nickel-content NMC batteries over the past few years. SVolt (a global high-tech company and spin-off of the Chinese automobile manufacturer Great Wall Motors) has reportedly begun series production of their NMX cells, Renault has announced their strategy will rely on NMC cathodes, and SK Innovation announced intentions for commercial production of NMC cells using 90% Ni during 2021. SK Innovation also stated their plan to develop a 94% Ni NMC by 2025, highlighting a continued place for NMC, but also highlighting the difficulty in moving toward ever higher nickel-, and ever lower cobalt-, content NMCs.

However, there was also a resurgence for LFP (lithium ferrophosphate, using lithium iron phosphate) in 2020, and the chemistry has gained added importance. Automotive OEMs have come forward with plans to use this chemistry due to its lower cost and added safety, while the imminent expiry of IP relating to LFP will make it easier to manufacturer and export LFP outside of China. Nevertheless, IDTechEx considers layered oxide materials, such as NMC and NCA (lithium nickel cobalt aluminum oxides), to remain central to the success of vehicle electrification given the added range they provide. Beyond cars, a range of chemistries is utilized and offered by manufacturers, with choices coming down to application requirements and regional preferences.

Higher-Ni NMC chemistries have been gaining market share in BEVs. [Source: IDTechEx]

To find out more about trends in cell chemistry in battery electric vehicles (BEVs) and other vehicle segments, please see the report "Lithium-ion Batteries for Electric Vehicles 2021-2031."

Battery design

Shifts in battery pack design are also taking place. For example, 800-V architectures have been adopted by a number of OEMs, driven by promises of fast charging and more efficient operation. However, the necessary charging infrastructure also needs to be in place to fully utilize this resource, and the battery itself will need to be able to handle increased fast-charge powers. Greater care will also be needed to ensure electrical isolation of the battery pack, while the necessary shift from Si (silicon) to SiC (silicon carbide) inverters comes with its own costs.

Cell-to-pack (CTP) designs are also being explored. Here, the greater packing efficiency can help overcome the energy density reduction that comes from LFP. Automaker BYD (China/the world's top-selling plug-in car manufacturer), battery manufacturer CATL (China's largest battery maker), Tesla, and Stellantis (formerly Fiat Chrysler) have all announced their intention to use LFP cathodes (perhaps LMFP in Stellantis' case) in combination with CTP battery designs.

However, outside of electric cars, modularity remains important, with most pack manufacturers in Europe and North America offering modular designs. The increased redundancy and repairability take on added importance in commercial sectors, while the design also allows pack manufacturers to serve multiple vehicle segments more easily.

An array of options exist for improving Li-ion battery performance and cost. [Source: IDTechEx]

Of course, cathode chemistry and battery structure are only parts of the puzzle. Cell design and form factor, solid electrolytes, anode material choices, thermal interface materials, and battery management systems all form parts of the battery design ecosystem, with numerous avenues for improving battery and EV performance, cost, and safety.

An array of technological possibilities, and a diverse set of design choices, are opening up in the battery and electric vehicle landscape. For analysis on the developments in battery and electric vehicle technology and markets, again, please see the report "Lithium-ion Batteries for Electric Vehicles 2021-2031."

Find more information on IDTechEx's energy storage and electric vehicle research at www.IDTechEx.com/Research.

Electric vehicle motor types

Despite electric traction motors originally being developed in the 1800s, the market is still evolving today with new designs, improved performance, and more considerations around the materials used. These are not just incremental improvements either, with developments such as axial flux motors and various OEMs eliminating rare-earths altogether. The latest report from IDTechEx, "Electric Motors for Electric Vehicles 2022-2032," takes a deep dive into this market, assessing trends, benchmarking, and giving market forecasts through to 2032.

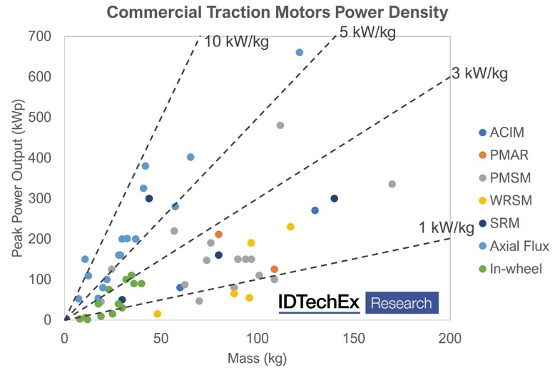

There are several key performance metrics for electric motors. Power and torque density enable improved driving dynamics in a smaller and lighter package, with weight and space being at a premium in EVs. Another critical area is efficiency. Improving efficiency means that less of the precious energy stored in the battery is wasted when accelerating the vehicle, leading to improved range from the same battery capacity.

Due to the many different considerations in motor design, the EV market has adopted several different solutions including permanent magnet, induction, and wound-rotor motors. In many cases, a combination of options may be used to give the best overall solution. Each has its own pros and cons in terms of performance but also in terms of materials costs and supply, with permanent magnet motors relying on rare-earths with volatile pricing and a geographically constrained supply chain.

IDTechEx analyzes key parameters of motors in BEVs and emerging alternatives. [Source: IDTechEx]

Axial flux, in-wheel, and other emerging options

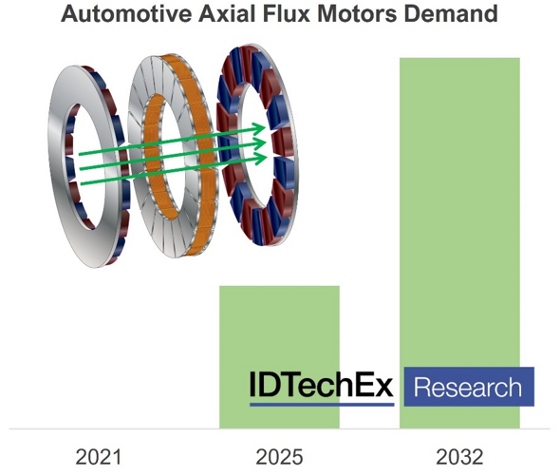

A key emerging motor technology is axial flux. The magnetic flux is parallel to the axis of rotation in an axial flux motor (compared to perpendicular in radial flux machines). While almost the entire EV market is using a form of radial flux motor, axial flux motors present several benefits. These include increased power and torque density and a pancake form factor ideal for integration in various scenarios.

Despite the previous lack of adoption, the technology has evolved to the state where we have seen significant interest. Daimler acquired key player YASA to use its motors in the upcoming AMG electric platform, and Renault has partnered with WHYLOT to use axial flux motors in their hybrids starting in 2025. The axial flux market in automotive EVs is very small today, but IDTechEx expects a huge increase in demand over the next 10 years, with first applications in high-performance vehicles and certain hybrid applications.

IDTechEx forecasts a large increase in demand for automotive axial flux motors. [Source: IDTechEx]

IDTechEx also sees some promising applications for other alternatives to typical EV motors such as in-wheel motors and switched reluctance motors. In-wheel motors can eliminate much of the drivetrain components that would normally take up space within the cabin of the vehicle and provide benefits such as torque vectoring. Lordstown announced the use of Elaphe's in-wheel motor for its electric trucks, and other players like Protean are providing in-wheel motors to autonomous shuttles.

Switched reluctance motors are by no means a new technology, but they are making somewhat of a resurgence in certain segments with improvements to their design and control. Advanced Electric Machines (AEM) is providing commercial vehicles and developing a motor with Bentley. Switched reluctance machines are much simpler to manufacture than many others and utilize no rare earths; in fact, some like AEM and RETORQ motors are moving to aluminum windings in order to avoid copper.

The new report from IDTechEx, "Electric Motors for Electric Vehicles 2022-2032," details OEM strategies, trends, and emerging technologies within the motor market for EVs. An extensive model database of over 250 EV models sold between 2015-2020 aids in a granular market analysis of motor type, performance, thermal management, and market shares. Technologies and markets are considered for cars, two-wheelers, light commercial vehicles (vans), trucks, and buses along with several use-cases and benchmarking. Emerging technologies are also addressed with market forecasts through to 2032 such as axial flux and in-wheel motors.

Published October 2021

Rate this article

View our terms of use and privacy policy